82% of small businesses fail because of cash flow. Yes, it’s that high! It’s daunting to hear these facts. What can small business owners do to avoid becoming another statistic?

A good start is establishing a financial system that includes secure funding options for your business. Except… there are so many funding options. How do you find them? How do you know which ones to choose? What’s the safest option?

It gets confusing! That’s why you can find secure ways to finance your business right here.

1. Federal, Provincial or State Small Business Loans

Your local federal, provincial or state small business office can help you explore loan options.

There is the US Small Business Administration (SBA). It finances small business loans from $500+.

The Canada Small Business Loan program will finance businesses that operate under ten million dollars in gross revenue.

Both require some collateral, but each institution has different guidelines which can be found on their websites.

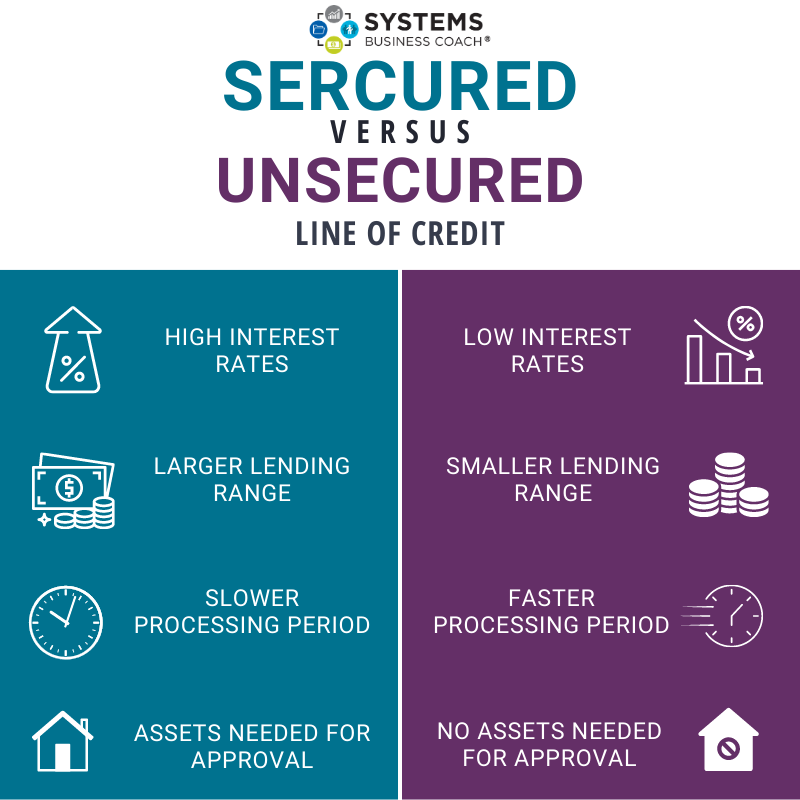

2. Bank Unsecured Line of Credit

This funding option is suitable for smaller loans. Think somewhere between $5,000 and $10,000. People are usually quickly approved for an unsecured line of credit. This is because there are no assets or collateral needed for this loan.

(Side note: If you’re like me, and need a reminder, an asset is something you own that has value. This could be property, a vehicle or a certain inventory in your business.)

The downside to an unsecured line of credit is that it has a high-interest rate.

Heads up, the interest rates of an unsecured line of credit do fluctuate depending on which banks you go to and the current market rate.

You can plan a meeting with a representative at your bank to access this option.

3. Bank Secured Line of Credit

You can use a secured line of credit as a funding option for your small business. This is different than an unsecured line of credit because you use your assets to secure the loan.

With a secured line of credit, you will have a longer processing period as a bank needs more time to verify your assets.

On the plus side, you’ll have access to lower interest rates, more money ($10,000+) and the option of paying monthly. This means you can pay back your loan in small chunks.

And you will have to pay it back. It’s not a grant or a gift. You might think that’s a bit obvious, but I’ve met too many people who think of credit cards and lines of credit as free money. It’s just not. Especially when your assets are backing your loan.

One of the most popular assets a bank will ask for comes in the form of a mortgage on your home. Unless you are 100% positive that your business will be profitable in a short time frame, think carefully before putting your home on the line.

If you default on a loan, your assets can be repossessed. This threatens the security of your family and home if the business doesn’t perform as you hoped.

4. Alternative Lending Programs

There are lots of loan programs designed to help finance your small business. They vary and often aim to help specific groups. Such as students, women, First Nations and Indigenous people, youth, or people with disabilities.

Some great lending programs are:

- Futurpreneur. They support entrepreneurs Canada-wide.

- Women’s Enterprise Centre. They help BC Women start, lead and grow their businesses.

- If you live in a rural Canadian area, Community Futures is focused on supporting your small business.

These places also support small business owners through coaching and training, similar to what we do here at Systems Business Coach.

For an in-depth look at these lending programs and more funding options, you can download our report on How The Canadian Government Helps Small Businesses with Training and Coaching.

5. Government Grants

There are a wide variety of government grants available to finance your small business. These grants are specific. So finding the right fit for you can be time-consuming. And once you find the right one, the application process is often lengthy.

The good news is, once you secure a grant, the money is yours. No need to pay it back.

Plus, I’ve linked some great grants here to save you time.

There’s the Canada Job Grant. The details of this initiative vary depending on your province/territory. Overall, the intention is to provide funding for employers to train employees. Which will lead your business to greater profits and growth.

Find your province/territory details here:

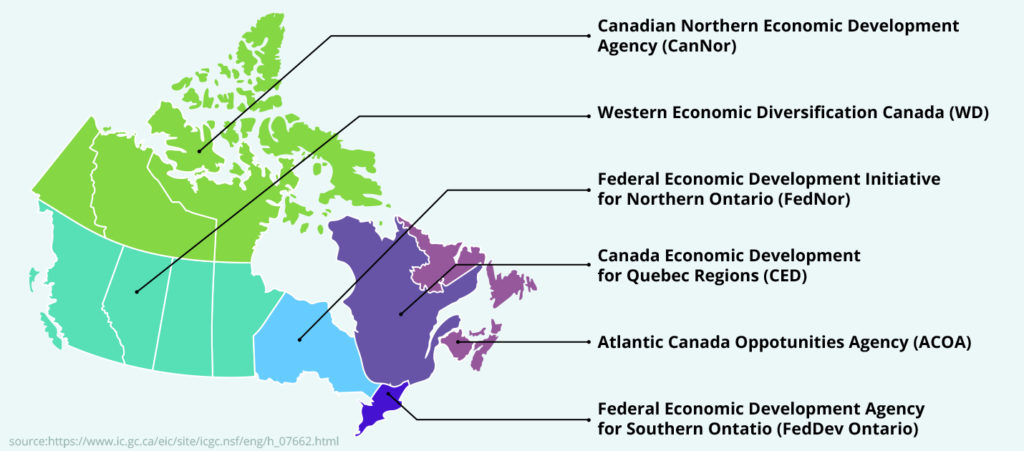

There’s also the Canada Regional Development Agencies (RDA). The RDA has funding options to support business growth and innovation.

This grant is split by six regions. Check out which region you can apply to:

I’d also recommend checking in with your municipal government. Cities tend to have funding available for their small businesses.

6. Suppliers

Another secure funding option for your business is to ask a creditor to loan you supplies. A creditor is a person or company that can loan you items, money or services.

Say you want to sell dishware and you don’t have enough money to buy your inventory outright. You can ask a dishware supplier to loan you some dishes on credit. Once you sell them, you pay back the supplier.

If you have a new business, a creditor may require a personal guarantee. When you sign a personal guarantee, you agree that you will pay the debt if the company becomes unable to. Creditors will usually help you if you have a sound credit rating.

Your credit rating can be determined by:

- If you’ve paid back previous debt/loans on time.

- How long you’ve had credit accounts for. The longer you’ve had your accounts in good standing, the higher you credit rating is.

- The variety of credit accounts. If you have a student loan, car loan, mortgage payment and credit card, you’ll be in for a higher rating than someone with just a credit card.

- If you are constantly opening new credit accounts. This can look risky and decrease your credit score.

You can check out an extensive list of what affects your credit rating here.

Paying your debt back on time has the biggest affect on your credit rating. When accessing this funding option, be sure you can meet your creditor’s repayment terms on time.

You can negatively impact your credit score with one late payment, and besides, credit card interest rates can completely wipe out any profit.

7. Leasing

Leasing is a great for when you need new equipment to grow your business. Vehicles, copying machines, heavy machinery and other types of equipment can be leased instead of purchased.

This means you can pay monthly payments instead of paying in full, up-front for equipment.

A lease is helpful when you don’t have enough money to buy your equipment outright. Or if you were to buy it, you’d be left with no money for anything else.

Leases usually require that you have been in business for two years, but if you have a good credit score, you may well qualify.

There is usually a small down payment when you apply for a lease. Also, interest rates tend to be high. (More than your average loan.) And be aware of balloon payments. The last monthly payment of your lease can be blown up to a much larger sum than previous payments. Think blown up like a balloon!

Be sure that you can afford the monthly payments before utilizing this type of funding. If not, your credit rating could take a hit.

What Funding Option Fits your Small Business?

Do any of these stand out to you?

Whatever you choose, I’d suggest overestimating the money you need. Borrow 25% more than you think you’ll need, and don’t spend the extra.

If you want to discuss funding options for your business, talk to me in the comments! We can hash out the pros and cons of your choice.

Always here to help!

Until next time, enjoy your Entrepreneurial Journey!

Want more ways to fund your business?

Download my report on How The Canadian Government Helps Small Businesses with Training and Coaching.