If you’re home and unable to work because of illness, injury, or quarantine, you shouldn’t be worrying about how to buy food or pay the rent. Employment Insurance (EI) is a safety net for times like this, and can provide up to 15 weeks of income replacement to Canadians quarantined because of the COVID-19 pandemic.

It’s not hard to apply for, and you can do it all from home, online and on the phone. The usual 1 week waiting period is waived so you can get support from day 1 of your quarantine, and you won’t have to provide a medical certificate or doctor’s note.

There’s a five step process you’ll want to follow, and before you even begin on that you’ll want to determine what type of EI you’re eligible for. Here’s a roadmap for the process:

- Call the COVID-19 EI hotline

- Put together your information

- Fill out and submit your online application

- Speak with Service Canada

- Submit bi-weekly updates

Before You Begin: Determine which type of EI you’re eligible for

Why you’re applying for EI will determine what process you need to follow, so here I’ve divided up the categories you might fall into.

Category 1 involves everyone out of work due to self-quarantine. You don’t have to be laid off work to qualify, but your quarantine can’t be your own decision: either your employer or a medical professional must have asked you to stay at home. You can be a freelancer, so long as you can’t continue your freelancing during quarantine. You don’t need a medical certificate, but you do need to be unable to work at home.

If you aren’t quarantining but are out of work because your workplace closed due to COVID-19, you may also be eligible for EI benefits. Let’s call this category 2, since the application process is different.

To qualify for this you’ll need between 420-700 hours of insurable employment during the qualifying period. The exact number depends on the unemployment rate in your region, and you can look it up here. For instance, if you lived in Vancouver, you would need 700 hours of insurable employment to apply for EI. Note this number should reflect all your workplaces combined.

If you’re on quarantine but will finish your quarantine to find your workplace is closed because of COVID-19, your application process is still different. I’ll call this scenario category 3.

Now, if you’re category 1, you’ll be going through steps 1-5. For category 2, you’ll go through steps 2, 3, and 5, and if you’re category 3, you’ll want to do a modified 1-5. It’s not as difficult as it looks, I promise!

Your EI Application, Step 1: Call the COVID-19 Hotline

This step only applies to category 1 & 3: people who are on quarantine because of COVID-19. If that’s you, you’ll need to call the COVID hotline between 8:30 am and 4:30 pm. There is a very high volume of calls right now, and you should expect to be on hold for several hours: have your phone plugged in, leave the speaker on, and be somewhere where you can answer quickly when you’re picked up on. Here’s the number: 1-833-381-2725.

Don’t wait till you’ve spoken to a operator before you go on with the process. In fact, you should be able to do steps 2 & 3 while you’re waiting for someone to pick up.

Step 2: Get Your Information Together

Here’s a list of all the information you want to have at the ready before you begin filling in the online form, in step 3.

- The first and last date of your employment

- Your SIN Number. Note: If your SIN begins with a 9, you’ll need to supply proof of your immigration status and work permit.

- Your mother’s maiden name.

- Your mailing and residential addresses, including the postal codes.

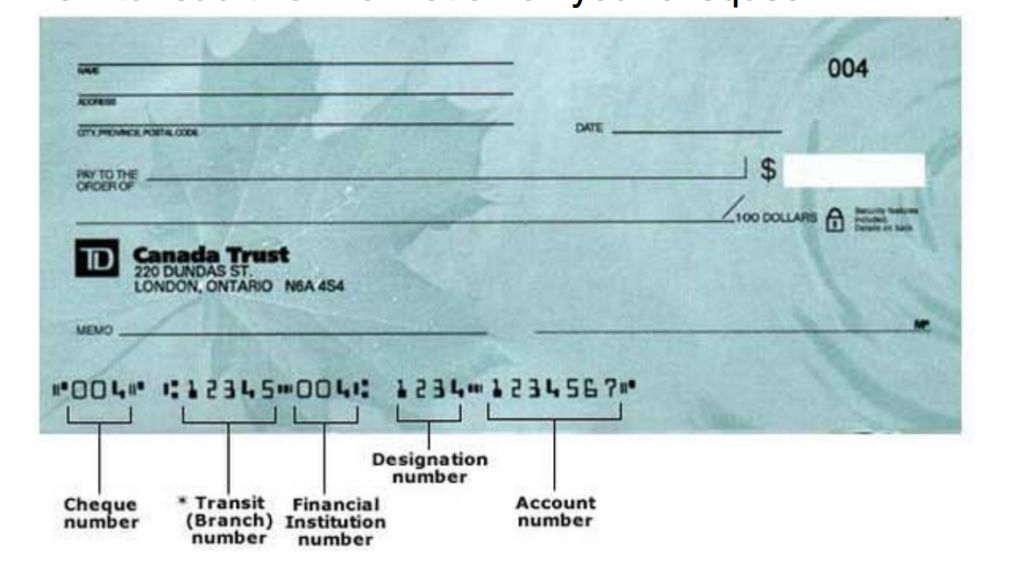

- Your complete banking information to sign up for direct deposit, including the financial institution name, bank branch number, and account number. You can get this from your online bank account or a blank cheque.

- Paystubs or cheque for highest earning 2 week period in the last year.

This last may be the most difficult to dig up, and for right now, you just need the numbers. In the long term, though, the paper is important: you can be audited and will have to show this proof.

The key is to find the two weeks of the last year—any two weeks, they don’t have to be consecutive—in which you were paid the most. This amount may be split over several employers; that doesn’t matter. Tips don’t count, unless they are “controlled tips”, collected by and paid to you by your employer. You’ll want to list the amount before any deductions.

Your EI payout will be 55% of this two week pay, capped at $900 bi-weekly. That means if you were paid $100 per week on your highest earning weeks, you’ll receive $55 a week EI.

Apply Online: One Simple Form

Once you’ve called the COVID-19 hotline (and been put on hold) and gathered your information together, the next thing you’ll want to do is apply online. The form is fairly simple and self explanatory. If you are in category 1 and 3, choose ‘medical leave’ as the reason you aren’t working. The usual medical note is waived so that you can stay at home, and you’ll get 14 days of paid leave for your standard isolation.

If sometime during your isolation you develop symptoms, you may need to restart the clock. At that point you will need to update Service Canada although this is changing by the day.

If you’ve been on quarantine and now your job doesn’t exist, you should ask you work to email you a layoff notice. Use this to change your EI claim type after the 14 days is over—but not before. The number you’ll need for that is 1-833-381-2725.

If you’re category 2 and your workplace was closed because of COVID, you’ll also want to ask your employer to give you a notice of layoff till work restarts. In this case you’ll want to select “layoff” rather than “medical leave’ as the reason you aren’t working. You won’t have to reapply once 14 days are over.

When you’ve submitted your form, write down the confirmation number you receive.

There’s one more submission needed before your application can be approved: your Record of Employment (ROE). Your employer can submit that here, or you can send in a paper version to:

Service Canada Center,

W-T Region

P.o. box 245

Edmonton AB

Speak to Service Canada

While you were hunting for pay stubs and filling in the online form, your phone was still on hold with the COVID-19 hotline. You may still have an hour or two to wait; estimates range from 3-6 hours before you get to speak to a person. Get comfy and don’t stress in the meantime.

Once your call is connected, you’ll be asked for your SIN number, your name and birthdate. That’s just to enable the operator to find the EI application you’ve just submitted. You’ll be read a statement, something to the effect of “I am currently out of work or in quarantine under the advisement of my doctor, a health care professional or by request of my employer.”

If you say yes to this statement, the one week waiting period for new EI claims is waived. If you disagree, you won’t be covered under this COVID-19 program and will not be paid for the first week of unemployment.

Remember, the operators manning these calls are overwhelmed and likely exhausted, answering call after call. It’s not their fault that you just waited six hours. Be kind, don’t bark, and do anything you can to make their job easier.

Keep Service Canada Updated

One requirement of the EI program is keeping Service Canada updated on your situation. You’ll need to submit an update biweekly, either online or on the phone.

If you are calling the update in, the number you need is 1-800-531-7555. You’ll need to identify yourself, and may be asked for the last 3 digits of your SIN, or the first 2 digits of a 4 digit access code you’ll receive in the mail.

Online login credentials will also be mailed to you when your application is processed, but it may take up to three weeks because of the overwhelming demand Service Canada is facing during this pandemic.

What Now?

If you’ve gone through these five steps, you should be good to go. If your application is not processed as quickly as you might expect, double check that your employer actually submitted your ROE— Service Canada will not begin to process your files until that is in

That’s all there is to it! Now make yourself some tea, put on your favourite music, and spend some time focusing on your own mental, physical, and emotional health. The world is a confusing, scary place right now, and you need this time to ground yourself and get ready for whatever comes next. You’ll emerge stronger, more resilient, and more ready to create positive change wherever you go.